Acknowledge common confusion around Medicare

Many people approaching Medicare feel overwhelmed. Parts, enrollment windows, premiums, and coverage rules raise many questions. That confusion is understandable. Medicare was designed decades ago and has grown into a program with several components. For someone making coverage decisions for the first time, the rules and options can seem complex.

Premier Insurance Solutions regularly helps seniors and their families sift through these details. Our role is educational: assisting people to understand Medicare’s structure before they speak with licensed advisors or review plan-specific options. Over time, we’ve seen the same themes: uncertainty about what Original Medicare covers, questions about supplemental options, and concern about timing. Those are sensible concerns. They deserve clear, practical explanations.

Why understanding how Medicare works matters

Understanding how Medicare works helps people avoid coverage gaps and unexpected costs. It also makes it easier to compare choices objectively. Knowing basic terms — like premiums, deductibles, copays, and coinsurance — reduces anxiety and supports better discussions with licensed advisors or trusted resources.

Good information does not replace personalized advice. Yet a clear overview prepares you to ask focused questions and to collect the documents and dates you will need when you seek tailored guidance.

What to expect from this overview

This overview is designed to give you a foundation before reviewing more detailed Medicare guides or plan comparisons.

This piece lays out the program at a high level. It describes Original Medicare, other ways coverage can be arranged, enrollment timing, cost components, common misunderstandings, and practical next steps. The tone is educational and neutral. The goal is to reduce confusion and help you prepare for deeper, personalized conversations.

The material is factual and conservative in its presentation of options. It is educational, not prescriptive.

What Medicare Is: Big Picture

What Medicare is and who administers it

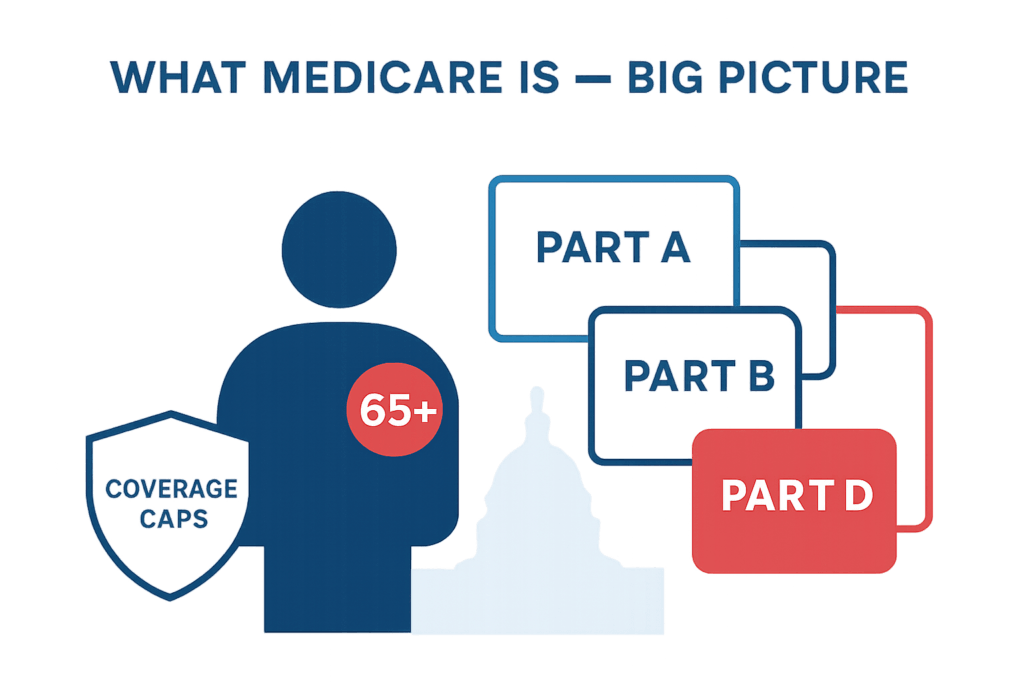

Medicare is a federal health insurance program primarily for people age 65 and older. It also covers certain younger people with disabilities and people with End-Stage Renal Disease in specific situations. The program is governed by the Centers for Medicare & Medicaid Services (CMS).

Medicare is not run by a private company. Medicare’s rules and coverage categories are based on federal statutes and CMS guidance. Private companies administer certain plan types under contract with CMS, but the underlying program and eligibility rules are federal.

Who qualifies for Medicare?

Most people become eligible for Medicare when they turn 65. Eligibility can also be granted earlier to individuals who qualify due to disability or certain medical conditions. People who receive Social Security retirement benefits are typically enrolled automatically at age 65 if they are already receiving benefits.

Those not receiving Social Security at age 65 usually need to sign up during the initial enrollment period. Exact qualification details can vary, so it helps to confirm with an official source or a licensed advisor.

What Medicare generally covers and what it does not

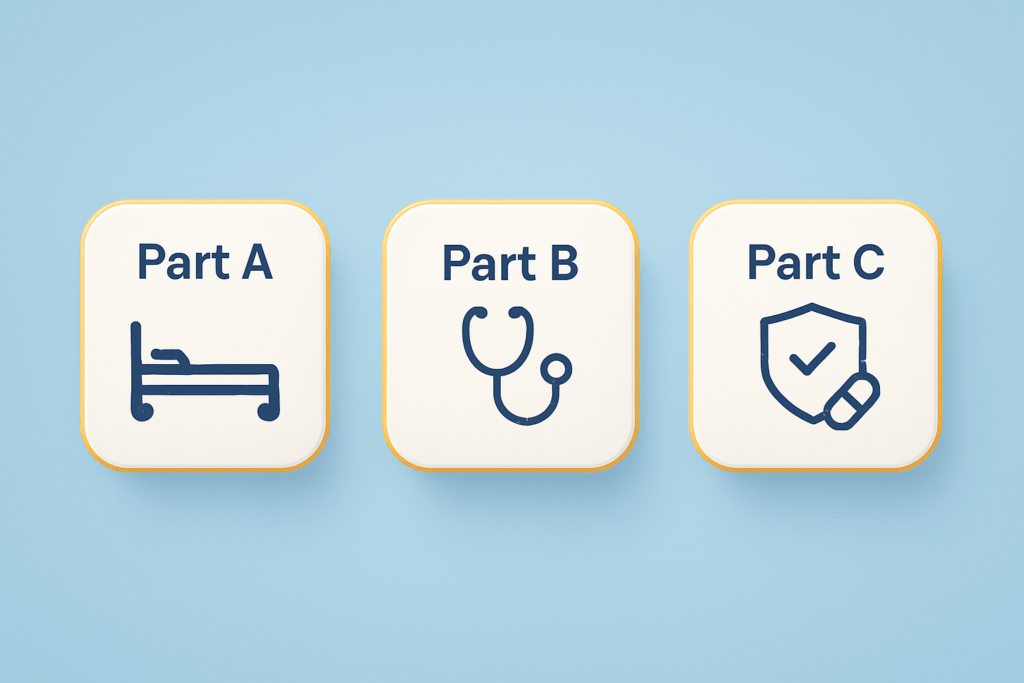

Medicare is split into parts — commonly called Medicare Parts A, B, C, and D — that cover different services. Broadly:

– Hospital care and related inpatient services are covered by Medicare Part A.

– Physician visits, outpatient care, and some preventive services are covered by Medicare Part B.

– Prescription medications are covered through Medicare Part D or through some Medicare Advantage plans that include drug coverage.

– Long-term custodial care, most dental care, routine vision and hearing services, and many long-term personal care expenses are not covered by Original Medicare.

Original Medicare focuses on medically necessary care and acute services. For services not covered, beneficiaries often use supplemental plans, Medicare Advantage, or private insurance to help fill gaps. Long-term care needs are commonly financed through personal savings, long-term care insurance, or Medicaid for those who qualify.

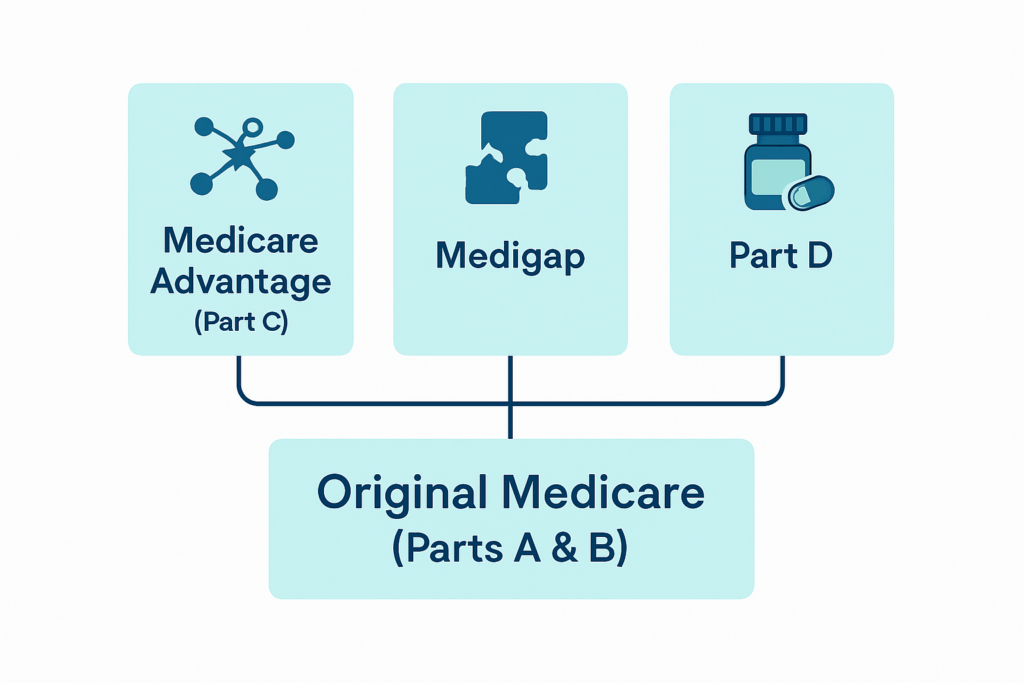

Why Medicare is not a single plan

Medicare is a program made up of distinct parts. Beneficiaries can receive coverage through Original Medicare (Parts A and B) or through alternative arrangements such as Medicare Advantage (Part C), which bundles benefits and is offered by private insurers. Additionally, people may add Medigap (Medicare Supplement) policies to Original Medicare or purchase Part D prescription drug coverage.

These choices mean there is no single “Medicare plan” that fits every person’s needs. The choices affect provider access, cost-sharing, and how prescription drugs are handled.

Original Medicare Explained

Medicare Part A hospital coverage

Medicare Part A covers inpatient hospital care, skilled nursing facility care (under certain conditions), hospice care, and some home health services. For most people, Part A is premium-free if they or a spouse paid Medicare taxes for a sufficient period while working.

Part A includes a deductible for each benefit period and may consist of coinsurance for extended hospital or skilled nursing stays. Medicare guidelines define eligibility rules and the precise services covered by Part A.

Medicare Part B medical coverage

Medicare Part B covers medically necessary services such as doctor visits, outpatient care, preventive services, and specific durable medical equipment. Part B typically requires a monthly premium. The Part B benefit also has an annual deductible and usually includes coinsurance or copayments for many services, commonly 20 percent of the Medicare-approved amount after the deductible.

Part B is oriented toward outpatient and professional services. Many preventive services are covered at no cost if Medicare’s screening or preventive criteria are met.

Typical services covered under Parts A and B

Original Medicare’s coverage includes a broad range of acute care services. Examples include:

– Hospitalization for surgery or acute illness (Part A)

– Doctor visits and specialist care (Part B)

– Outpatient procedures and diagnostic tests (Part B)

– Some home health services (Part A and Part B, depending on circumstances)

– Hospice care for terminal illness (Part A)

These services are covered when medically necessary and when providers accept Medicare assignment, which affects patient costs.

Common gaps in Original Medicare

Original Medicare does not cover long-term custodial nursing home care, most dental care, routine vision and hearing services, and many prescription drugs. It also generally does not cover care received outside the United States.

Because of these gaps, many people add supplemental coverage. Medigap policies can help cover cost-sharing in Original Medicare. Part D plans address most outpatient prescription drug needs. Medicare Advantage plans sometimes include additional benefits, though they may come with different networks and rules.

Other Ways Medicare Coverage Can Work

Medicare Advantage Part C Explained

Medicare Advantage plans, also called Part C, are offered by private insurers under contract with CMS. These plans provide Part A and Part B benefits and often include Part D drug coverage. Some Medicare Advantage plans also offer extras such as routine dental, vision, or fitness benefits.

Medicare Advantage plans typically use provider networks and may require prior authorization for certain services. Cost structures differ from Original Medicare; out-of-pocket costs may be lower or higher, depending on the plan design. People should review network rules, referral requirements, and cost-sharing details when comparing Medicare Advantage options.

Medicare Supplement Medigap Explained

Medigap, also known as Medicare Supplement insurance, is sold by private companies to fill cost-sharing gaps in Original Medicare. These policies can cover deductibles, copayments, and coinsurance not paid by Parts A and B. Medigap policies follow standardized plan types in most states, labeled by letters (for example, Plan G).

Medigap does not work with Medicare Advantage. If you enroll in a Medigap policy, you retain Original Medicare as your primary coverage. Medigap policies usually require a separate premium in addition to the Part B premium.

Medicare Part D prescription drug coverage Explained

Medicare Part D covers outpatient prescription drugs through private plans approved by CMS. Part D can be purchased as a stand-alone plan to accompany Original Medicare or may be included in many Medicare Advantage plans.

Part D plans have formularies, tiers, and rules that affect costs and access. Some plans have an annual deductible, plus copayments or coinsurance for prescriptions. If you delay Part D enrollment without other qualified drug coverage, you may face a late enrollment penalty unless you have credible coverage from another source.

How these options fit into the overall Medicare system

Original Medicare (Parts A and B) provides the federal baseline. Part D adds drug coverage. Medicare Advantage replaces Original Medicare by offering an alternative way to receive Part A and Part B benefits, frequently including drug coverage. These options represent different trade-offs between provider flexibility, cost predictability, and plan structure.

Choosing among these options affects provider access, out-of-pocket costs, and how you manage prescription drugs. There is no universally correct choice: individual health needs, budget, provider preferences, and willingness to accept network limitations all matter.

Enrollment Periods and Timing

Initial Enrollment Period and how it works

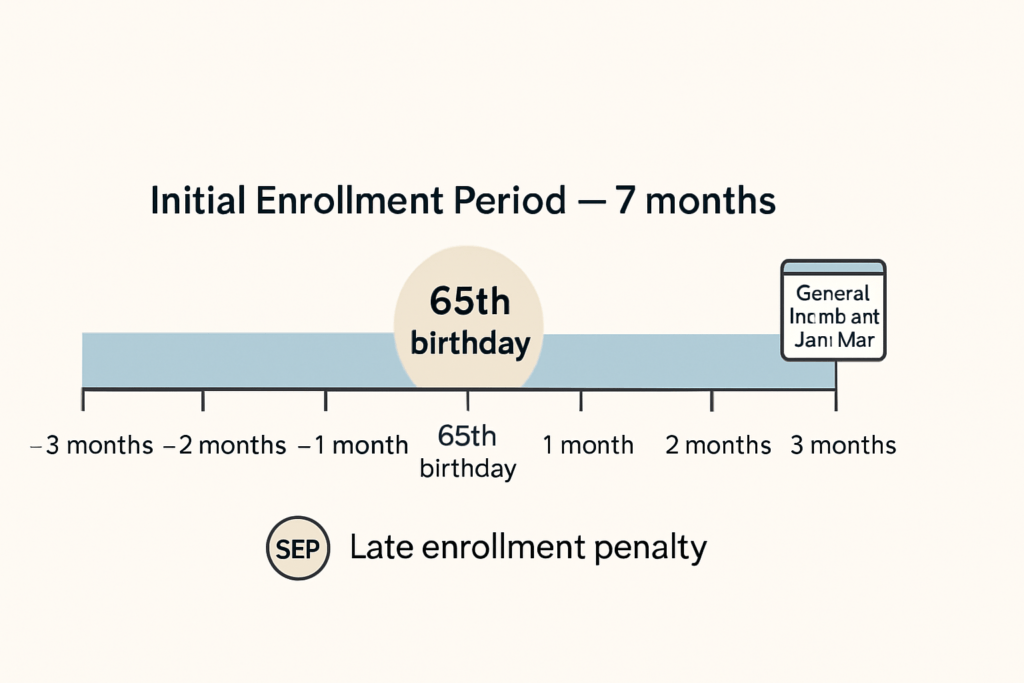

Most people have a 7-month initial enrollment window that begins 3 months before their 65th birthday, includes their birthday month, and ends 3 months after. During this period, people may sign up for Part A and Part B. If someone delays Part B because they have qualifying employer coverage, they may avoid a late enrollment penalty, but they should carefully verify eligibility requirements.

Automatic enrollment can occur for people already receiving Social Security benefits. Others must actively enroll to avoid coverage gaps or penalties.

Special and General Enrollment Periods

Special Enrollment Periods (SEPs) allow enrollment outside the initial window for specific life events, such as losing employer group coverage. The General Enrollment Period runs annually from January 1 through March 31 for people who missed initial enrollment and do not qualify for an SEP. Coverage in that case typically begins July 1 of that year.

Specific rules and time limits vary by situation. It helps to check official Medicare resources or consult a licensed advisor when deadlines are a concern.

Why timing matters for coverage and costs

Timing affects the start date of coverage and whether penalties apply. Late enrollment penalties can increase premiums for as long as the person has Medicare. There are also coverage gaps that can arise if one skips enrollment and later needs care.

Careful planning around enrollment dates can prevent unnecessary costs and ensure continuity of care. Collecting required documentation and confirming employer or other coverage status in advance reduces the risk of surprises.

Neutral mention of potential late enrollment penalties

Late enrollment penalties may apply to Part B and Part D if someone does not enroll during the appropriate period and lacks qualifying coverage. The penalties are calculated based on the length of time without coverage and are added to the monthly premium. Once assessed, late enrollment penalties typically continue for as long as Medicare coverage is in place, so scheduling enrollment appropriately matters.

Understanding Medicare Costs

Premiums and what they pay for

Premiums are regular payments that keep a plan active. Part A is premium-free for many people with sufficient work history; others pay a premium. Part B requires a monthly premium for most beneficiaries. Medicare Advantage and Part D plans also have premiums that vary by plan.

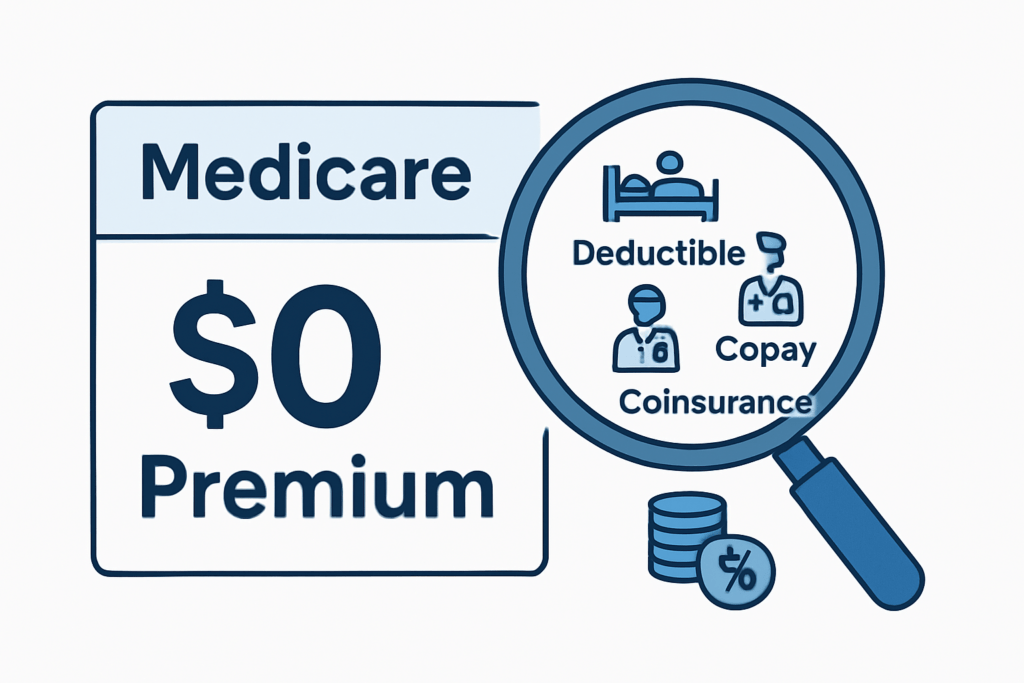

Premiums do not cover every medical cost. They secure enrollment and contribute to the cost of care, while deductibles, copays, and coinsurance cover part of the expense when services are used.

Deductibles and when they apply

A deductible is the amount a person must pay out of pocket before Medicare begins to pay for certain services. Part A has a per-benefit-period deductible for inpatient hospital stays. Part B has an annual deductible for outpatient and physician services. Some Medicare Advantage and Part D plans include their own deductibles.

Knowing the deductible amounts for the plans you consider helps estimate potential annual costs.

Copays and coinsurance explained.

Copays are fixed amounts paid for a specific service, such as a doctor visit. Coinsurance is a percentage of the allowed amount you pay for a service after meeting the deductible. Original Medicare commonly uses coinsurance — for example, 20 percent for many Part B services. Medicare Advantage plans may use copays or coinsurance in different ways.

Understanding the difference between copays and coinsurance is helpful when comparing plan cost structures.

Why a $0 premium does not mean $0 cost

Some Medicare Advantage plans advertise a $0 monthly premium. That does not mean care is free. Such plans still have copays, coinsurance, deductibles, and network rules that affect what you pay when you receive services. Conversely, paying a separate Medigap premium in addition to Part B usually reduces out-of-pocket costs for covered services. Look beyond the headline premium to the full cost picture.

Common Misunderstandings About How Medicare Works

Misconception: Medicare covers everything

A common belief is that Medicare will cover all health-related expenses. That is not accurate. Original Medicare covers many medically necessary services but excludes routine dental, vision, hearing aids, and most long-term custodial care. Prescription drug coverage is not included in Original Medicare unless a Part D plan is added.

Clarifying what Medicare does not cover helps people consider additional coverage options or financial planning for care needs not covered by Medicare.

Misconception: Medigap and Medicare Advantage are the same

Medigap policies and Medicare Advantage serve different roles and are not interchangeable. Medigap supplements Original Medicare by covering cost-sharing; it is compatible with Parts A and B but does not include prescription drugs. Medicare Advantage plans replace Original Medicare in most respects and often include prescription coverage, but they usually limit provider choice through networks and may have different cost-sharing structures.

Understanding these differences helps people match coverage arrangements to their priorities regarding provider access, cost predictability, and benefit extras.

Misconception: prescription drugs are always included

Another common misconception is that prescription coverage is automatic with Medicare. It is not. To have prescription coverage, people must enroll in a Part D plan or choose a Medicare Advantage plan that includes drug benefits. Without creditable drug coverage, late enrollment may trigger a penalty.

Careful review of medication lists and plan formularies helps identify the most appropriate Part D plan or identify whether a Medicare Advantage plan’s drug benefit meets individual needs.

Precise, factual corrections to each misconception

The corrections above are straightforward: confirm what is and is not covered under Original Medicare; recognize the structural differences between Medigap and Medicare Advantage; and verify whether prescription drug coverage is in place.

Checking facts with CMS or a licensed advisor will provide confirmation tailored to personal circumstances. Documentation and plan materials provide specifics on covered services, cost-sharing, and rules.

Practical Steps to Prepare for Deeper Learning

How to gather basic personal information

Before meeting with a licensed advisor or reviewing plan options, assemble a few items:

– Dates: birthdate, retirement date, and any dates coverage began or ended.

– Current insurance: employer group coverage details, including whether it is active and whether it includes prescription drug coverage.

– Medications: a list of current prescription drugs, dosages, and frequencies.

– Providers: names of preferred doctors and hospitals.

– Financial considerations: approximate budget for premiums and out-of-pocket expenses.

Having these details on hand makes conversations more efficient and reduces the risk of missing critical deadline-driven choices.

Questions to ask a licensed advisor or official resources

When you speak with a licensed advisor or consult CMS resources, consider asking:

– Which services are covered under my current or proposed plan?

– What are the annual deductibles and typical copays or coinsurance?

– Are my preferred providers in the plan’s network?

– How does the plan handle prescriptions, and are my drugs on the formulary?

– Are there enrollment deadlines or potential penalties I should be aware of?

These questions are practical and fact-focused. They will help you compare options without requiring technical familiarity with every rule.

What to expect from a fuller Medicare guide

A comprehensive guide will include detailed comparisons of Original Medicare, Medicare Advantage, Medigap, and Part D plans; examples of cost scenarios; explanations of enrollment rules; and checklists for next steps. It may contain state-specific notes on Medigap regulations and timelines.

Use such guides as a starting point. Personalized guidance that accounts for your health needs, financial situation, and provider preferences will still be necessary for decision-making.

Trust Safe Closing and Educational Disclaimer

Reassuring summary and next steps

Medicare consists of several parts that work together to provide health coverage for people age 65 and over and for some younger people with qualifying conditions. Original Medicare covers hospital and medical services, but there are gaps in coverage for prescription drugs and certain long-term care needs. Medicare Advantage, Medigap, and Part D are common ways beneficiaries arrange more complete coverage.

Prepare for choices by gathering key documents, listing medications and providers, and noting enrollment dates. Ask focused questions when you meet a licensed advisor or consult CMS for official guidance.

Encourage confirmation with licensed advisors or CMS

Premier Insurance Solutions provides education-first guidance and regularly assists people as they learn how Medicare works. For decisions about enrollment and specific plan selection, confirm details with a licensed Medicare advisor or consult official CMS resources. Official materials and licensed professionals can assess individual circumstances that a general overview cannot account for.

Educational disclaimer clarifying that this is general information

This content is intended to provide general Medicare education only. Coverage options, costs, and eligibility rules can vary with individual circumstances and may change over time. It is not legal, tax, or medical advice. Confirm details with a licensed professional or CMS before making enrollment decisions.